I was out of commission for a few days fighting a stomach virus so it seems appropriate to review some of the recent market happenings.

The market got a bit of a growth scare last week as several economic data points seemed a bit weaker than expected. The Philly Fed Survey was much weaker than expected and spooked the market quite a bit on Thursday and Friday. The Conference Board also released the Leading Economic Indicators on Thursday which were interpreted as weak. These two reports were enough to worry some that the economy is weakening too rapidly and could fall into recession. The yield curve continued to invert with the Ten Year Treasury note yield falling almost 3/4% below the Fed Funds rate. I must admit that level of inversion certainly makes me nervous. However, without further evidence, we continue to expect a slowdown that doesn't develop into recession.

The market has recovered to new highs for the move this week as consumer confidence and a report from the Richmond Fed cooled the recession fears. The Dow now stands a mere 33 points or so from its all time high. We expect that level to be broken soon, especially with the end of quarter window dressing that is happening this week. For those of you who don't know, window dressing is a practice that happens at the end of every quarter. It refers to the fact that mutual fund managers must reveal their portfolios at the end of every quarter. If it has been an up quarter, as this one has, those portfolio managers don't want to show too much cash on the books lest anyone actually read their quarterly report and complain that they weren't invested enough to take advantage of the rally. The reverse occurs when it's been a down quarter and those same portfolio managers will sell in the last week to make it look like they were holding cash. It's a silly game, but we know it gets played.

So, I was out for a few days, but nothing has happened to change our view. We are still overweight large cap stocks (which have outperformed during this rally) and underweight commodities (which have dramatically underperformed over the last two months). We do expect to see some consolidation of the recent gains in October as the election nears. Some will start to fear a Democratic takeover (although as we've pointed out, that's an unfounded fear) and sell stocks in anticipation. Political prognostication is not our area of expertise, but with the way incumbents have twisted the system in their favor, we don't think a huge turnover in Congress is likely. We think there is still upside to the market once the election is out of the way.

Wednesday, September 27, 2006

Oil in the Ground

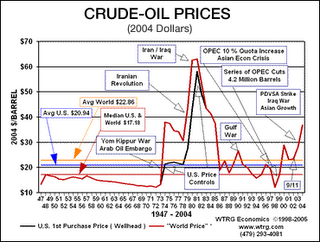

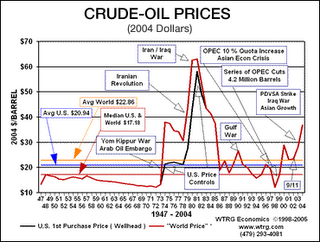

Max Singer has an article in the Weekly Standard about oil prices and predicts that oil will average $30/barrel over the next 50 years. Mr. Singer's opinion carries some weight as he was one of the few who predicted lower prices in 1980 when the vast majority thought prices could only go higher.

One thing I would like to point out about Mr. Singer's prediction however. He is referring to the inflation adjusted price. In other words, a 50% devaluation of the dollar during that time would result in an inflation adjusted price of $45/barrel. And that is one of the main reasons we always maintain investments in commodities. We fear the Federal Reserve's corrosive effect on the value of the dollar much more than we fear running out of oil or any other commodity. Dollar devaluations - or inflation since it's the same thing- show up in the price of commodities much sooner than the general price level.

The basic price of oil for the next 50 years will be about $30 a barrel. Some of the time it will be higher, but I would bet that a lot of the time it will be lower. The key point is that any investments made in oil or oil substitutes that depend on oil prices staying well above $30 a barrel stand a good chance of losing money. They are imprudent, risky investments--although nobody can say for sure that they won't pay off.

One thing I would like to point out about Mr. Singer's prediction however. He is referring to the inflation adjusted price. In other words, a 50% devaluation of the dollar during that time would result in an inflation adjusted price of $45/barrel. And that is one of the main reasons we always maintain investments in commodities. We fear the Federal Reserve's corrosive effect on the value of the dollar much more than we fear running out of oil or any other commodity. Dollar devaluations - or inflation since it's the same thing- show up in the price of commodities much sooner than the general price level.

Apologies

Apologies for the lack of posting recently. I've been under the weather with a nasty stomach virus. I'll catch everyone up on recent market happenings in the next day or so.

Wednesday, September 20, 2006

Oracle

For our clients who own Oracle Software, it's nice to report that the company reported great earnings after the close yesterday and the stock surged over 11% today. Net Income was up 29% on a 30% increase in revenue. Larry Ellison seems to be proving his detractors wrong again. With the acquisitions he's made over the last year, it now appears to be down to Oracle and SAP. I know who we're betting on. Click on the title to read the press release about the earnings. Here's a link to the conference call.

FOMC Meeting

The Federal Open Market Committee today voted 10-1 to maintain the Fed Funds rate at 5 1/4%. This was widely anticipated and the statement accompanying the vote also provided little in the way of new information. We have been saying for some time now that the Fed is likely done with this rate tightening cycle. None of the data released recently has changed our view.

We are becoming more cautious about the stock market however. Sentiment is becoming more bullish by the day and while it is not at an extreme yet, we are increasingly uncomfortable being in the majority. Bullish sentiment in the AAII poll, which surveys individual investors, has been creeping up with the market and stood at 48% last week. Bears still represent 38.4% of those polled so we don't think sentiment is at any kind of extreme yet. If the bear percentage starts to fall down into the 20s and the bulls get over 50%, we would start to expect some kind of correction. We'll keep you posted.

The longer term picture, in our opinion, still seems fairly bright. Oil fell under $61 today and that should help the US consumer, which is still the crucial piece of the worldwide growth puzzle. Other commodities also continue to correct with natural gas back under $5/mcf and gold now well under $600/oz. We believe the money coming out of commodities will be increasingly deployed in the stock market, particularly large capitalization stocks. The dollar seems to have stabilized which may help to attract more assets from overseas to stocks (although admittedly the flow of funds data recently released indicates that last month saw less foreign interest in US assets; we think that is a short term phenomenon related to Japanese repatriation of foreign exchange). The Mortgage Bankers Association today reported that refinance activity jumped by 9.5% last week. Falling mortgage rates are obviously having an effect even if not on the purchase side.

Things seem to be going pretty much according to our script and that makes us wonder what we're missing. We have said many times that predicting the course of the economy and/or the market in the short term is basically impossible. That applies to us as well as everyone else trying to predict the future. So, while we are happy that things seem to be going our way, we are worried that our outlook is starting to gain mainstream acceptance.

We are becoming more cautious about the stock market however. Sentiment is becoming more bullish by the day and while it is not at an extreme yet, we are increasingly uncomfortable being in the majority. Bullish sentiment in the AAII poll, which surveys individual investors, has been creeping up with the market and stood at 48% last week. Bears still represent 38.4% of those polled so we don't think sentiment is at any kind of extreme yet. If the bear percentage starts to fall down into the 20s and the bulls get over 50%, we would start to expect some kind of correction. We'll keep you posted.

The longer term picture, in our opinion, still seems fairly bright. Oil fell under $61 today and that should help the US consumer, which is still the crucial piece of the worldwide growth puzzle. Other commodities also continue to correct with natural gas back under $5/mcf and gold now well under $600/oz. We believe the money coming out of commodities will be increasingly deployed in the stock market, particularly large capitalization stocks. The dollar seems to have stabilized which may help to attract more assets from overseas to stocks (although admittedly the flow of funds data recently released indicates that last month saw less foreign interest in US assets; we think that is a short term phenomenon related to Japanese repatriation of foreign exchange). The Mortgage Bankers Association today reported that refinance activity jumped by 9.5% last week. Falling mortgage rates are obviously having an effect even if not on the purchase side.

Things seem to be going pretty much according to our script and that makes us wonder what we're missing. We have said many times that predicting the course of the economy and/or the market in the short term is basically impossible. That applies to us as well as everyone else trying to predict the future. So, while we are happy that things seem to be going our way, we are worried that our outlook is starting to gain mainstream acceptance.

Tuesday, September 19, 2006

Thai Coup Haiku

Thaksin at UN

Tanks in the Streets are rolling

The Baht is Falling!

Alright, I'm not much of a poet and Haiku really doesn't work in English anyway, but this story about the market today from AP is absurd:

I guess since the "Asian" crisis back in '97 started with the Thai Baht coming unglued, the AP thinks that US stocks will now react to every wiggle of an Asian currency. Of course, conditions then were much different than now, but economic research is not exactly the AP's strong suit. I suppose this could turn into something bigger, but I don't think traders decided to sell today because the Thai military (why does Thailand even have a military?) decided to kick the PM out while he was visiting the UN. This has been so widely rumored that even I had heard about it and I don't usually waste my time on Thai politics - Thai food yes, Thai politics no.

I think a more likely explanation for today's minor pullback is that we've had a nice run and some found this morning's housing numbers a good reason to take some profits. Housing starts and permits were both less than expected this morning as was PPI (wholesale inflation). I didn't find anything surprising about either stat and the market shouldn't have either. We still stand by our often stated view that housing will continue to slow, but won't push the US into recession. With interest rates falling again today -- more than we think is warranted by the way -- we suspect housing will find a bottom in the next couple of quarters.

Tanks in the Streets are rolling

The Baht is Falling!

Alright, I'm not much of a poet and Haiku really doesn't work in English anyway, but this story about the market today from AP is absurd:

Stocks dropped suddenly Tuesday after Thailand's military launched a coup against the country's prime minister. Traders watching Thailand closely are certain to remember how trouble in the kingdom had worldwide implications in the past: The Asia currency crisis that erupted in 1997 began with the devaluation of the Thai baht, then snowballed into a currency crisis in emerging markets around the world.

I guess since the "Asian" crisis back in '97 started with the Thai Baht coming unglued, the AP thinks that US stocks will now react to every wiggle of an Asian currency. Of course, conditions then were much different than now, but economic research is not exactly the AP's strong suit. I suppose this could turn into something bigger, but I don't think traders decided to sell today because the Thai military (why does Thailand even have a military?) decided to kick the PM out while he was visiting the UN. This has been so widely rumored that even I had heard about it and I don't usually waste my time on Thai politics - Thai food yes, Thai politics no.

I think a more likely explanation for today's minor pullback is that we've had a nice run and some found this morning's housing numbers a good reason to take some profits. Housing starts and permits were both less than expected this morning as was PPI (wholesale inflation). I didn't find anything surprising about either stat and the market shouldn't have either. We still stand by our often stated view that housing will continue to slow, but won't push the US into recession. With interest rates falling again today -- more than we think is warranted by the way -- we suspect housing will find a bottom in the next couple of quarters.

Monday, September 18, 2006

Orchid Blogging

As some of you know, I am an orchid and tropical plant fan. My collection is expanding but still small (about 100 orchids and various tropical plants) by the standards set by some of my friends (you know who you are). Anyway, it's been an exceptional year for blooms and I thought some of you might enjoy some photos:

More on Commodity Allocations

PIMCO recently commissioned a study by Ibbotson Associates regarding the use of commodities in Strategic Asset Allocations. The study provides indepedent confirmation of our own research into the use of commodities in our portfolios. The study is available through PIMCO's web site, but it is quite technical and is probably only suited for the true investment geeks among us. Here are some highlights:

In the last paragraph above, notice the phrase "Asset classes with low correlations to the current opportunity set of asset classes provide the largest benefit". At AIM we include Commodities and REITs in all our portfolios for exactly this reason. Both REITs and Commodities have low correlations to the traditional asset classes of stocks, bonds and cash. We believe using these assets in our portfolios will produce, over time, higher returns and lower volatility for our clients. Click on the title of this post to read an interview with PIMCO SVP Bob Greer. Full disclosure: AIM sometimes uses PIMCO funds in our allocations, specifically the PIMCO Commodity Real Return Fund.

This paper studies the role of commodities in a strategic asset allocation. Commodities are real return, real assets that are part of the consumable/transformable super asset class and the storeof-value super asset class. There are several methods of obtaining exposure to commodities. This paper focuses on the type of exposure to commodities produced by a fully collateralized total

return commodity index.

Using historical capital market assumptions based on annual data from 1970 to 2004, we found that including commodities in the opportunity set resulted in a superior historical efficient frontier, which included large allocations to commodities. Over the common standard deviation range, the average improvement in historical return at each of the risk levels was approximately 133 basis points.

No matter which set of returns was used, including commodities in the opportunity set improved the risk-return characteristics of the efficient frontier. Furthermore, commodities played an important and significant role in the strategic asset allocations. Given the inherent return of commodities, there seems to be little risk that commodities will dramatically underperform the other asset classes on a risk-adjusted basis over any reasonably long time period. If anything, the risk is that commodities will continue to produce equity-like returns, in which case, the forwardlooking strategic allocations to commodities are too low.

Most strategic asset allocations consist primarily of allocations to the three “traditional” asset classes—stocks, bonds, and cash. Expanding the investable universe beyond these three traditional asset classes improves the risk-return characteristics of a strategic asset allocation. Asset classes with low correlations to the current opportunity set of asset classes provide the largest benefit.

In the last paragraph above, notice the phrase "Asset classes with low correlations to the current opportunity set of asset classes provide the largest benefit". At AIM we include Commodities and REITs in all our portfolios for exactly this reason. Both REITs and Commodities have low correlations to the traditional asset classes of stocks, bonds and cash. We believe using these assets in our portfolios will produce, over time, higher returns and lower volatility for our clients. Click on the title of this post to read an interview with PIMCO SVP Bob Greer. Full disclosure: AIM sometimes uses PIMCO funds in our allocations, specifically the PIMCO Commodity Real Return Fund.

Why Our Portofolios Always Maintain Exposure to Commodities

At AIM, one of the essential components of our portfolios is exposure to commodities, usually in the form of an index fund. Based on interactions with clients, there is some confusion about why we think this is essential. This article by John Tamny in National Review provides a good answer to the question:

We invest in commodities because we don't trust the Federal Reserve (or the US Government if you prefer) to maintain the purchasing power of the dollar. History tells us that fiat currencies are inherently unstable and are ultimately undermined by the governments that use them. Since our mission is to protect the wealth that our clients have worked so hard to accumulate, we believe it is essential to maintain some exposure to commodities at all times. We can and do vary the percentages we have invested in commodities based on current conditions, but since so many crises are associated with commodity spikes, we think it is prudent to maintain some exposure at all times. We are currently undeweight commodities and in the current correction even that has hurt our performance, but we'll take some short term pain to ensure that our clients purchasing power is protected in the long term. Click on the title to read the whole story.

Returning to current monetary blunders, every supposed oil and commodity “shock” since 1971 has occurred alongside a major drop in the value of the dollar versus gold, and subsequently all commodities. Since both oil and copper are world commodities, the fact that their prices have risen so substantially in dollars as opposed to euros in recent years makes plain the impact of dollar instability on the nominal price of commodities.

We invest in commodities because we don't trust the Federal Reserve (or the US Government if you prefer) to maintain the purchasing power of the dollar. History tells us that fiat currencies are inherently unstable and are ultimately undermined by the governments that use them. Since our mission is to protect the wealth that our clients have worked so hard to accumulate, we believe it is essential to maintain some exposure to commodities at all times. We can and do vary the percentages we have invested in commodities based on current conditions, but since so many crises are associated with commodity spikes, we think it is prudent to maintain some exposure at all times. We are currently undeweight commodities and in the current correction even that has hurt our performance, but we'll take some short term pain to ensure that our clients purchasing power is protected in the long term. Click on the title to read the whole story.

Liberty Dollar

Here's a weird little story:

The coins are produced by an organization called NORFED:

I don't know anything about these coins, but isn't it ironic that the government deems it illegal to produce a coin that has more intrinsic value (it must since official government coins no longer contain silver or gold) than the official version? And why exactly would it be illegal to produce coins, but not jewelry?

WASHINGTON — The government Thursday warned consumers and businesses that it is illegal to use alternative money known as "Liberty Dollar" coins, which organizers promote as a competitor to the almighty dollar.

"We don't want consumers to be fooled," U.S. Mint spokeswoman Becky Bailey says, noting U.S. Attorneys offices across the USA have noticed a marked increase in inquiries about the coins.

The coins are produced by an organization called NORFED:

Evansville, Ind.-based National Organization for the Repeal of the Federal Reserve Act and the Internal Revenue Code, otherwise known as NORFED, has been making the Liberty Dollar coins for eight years and claims $20 million is in circulation. The group says the money, unlike official U.S. cash, has a hedge against inflation because it is made almost entirely of silver and is backed by stocks of silver and gold in a vault in Idaho.

I don't know anything about these coins, but isn't it ironic that the government deems it illegal to produce a coin that has more intrinsic value (it must since official government coins no longer contain silver or gold) than the official version? And why exactly would it be illegal to produce coins, but not jewelry?

Economic Calendar

Click on the title for this week's economic calendar. There's not much on tap this week except for the Fed meeting on Wednesday - and that shouldn't produce any surprises. Housing starts and building permits will give us clues about the housing market. PPI tomorrow should be benign. We expect crude inventories to continue to push oil lower.

Who Needs the IMF?

Newsweek has a story this week with the same title as this post. Unfortunately, they chose Kenneth Rogoff, a Harvard Econ Prof and former employee of the IMF, to write the article. Here's the opening graph:

First of all, the IMF was established to administer the currency regime known as Bretton Woods that was established after WWII. Since Nixon severed the dollar's link to gold and essentially killed Bretton Woods in the early 70s, the IMF has been looking around for a job. I guess it would have made too much sense to disband an agency whose mission was no longer valid. Second, the IMFs more recent role as lender of last resort to emerging market economies has produced questionable results at best. The moral hazard created by the existence of an IMF prepared to bail out any country that digs a deep enough hole means that profligate governments never receive the market punishment they deserve and that would teach them to follow basic, sensible economic policies. And lastly, the US is the biggest contributor to the fund; why should we give up any leadership position at the fund when it is lending our money? Who needs the IMF? No One! Click on the title to read the whole story.

Sept. 25, 2006 issue - As the international Monetary Fund holds its big fall meetings in Singapore this week, it faces a financial world that has been turned on its head. Traditionally, the Fund has helped out bankrupt emerging-market governments using loan money collected mainly from Western nations. But now, the Fund is being asked, in effect, to play a much broader role in helping maintain financial stability in a world where the lenders and creditors are trading places. With the United States borrowing two thirds of global net savings and Euro-zone countries like Italy, Greece and Portugal struggling to control their government finances—while emerging markets sit on mounting foreign-exchange reserves—many worry that ground zero for the next big global financial crisis could be somewhere in the wealthy West. Given that Asia now accounts for almost 40 percent of global income, and an even larger share of its surpluses, it makes no sense that IMF voting rights and leadership posts are still dominated by the United States and Europe.

First of all, the IMF was established to administer the currency regime known as Bretton Woods that was established after WWII. Since Nixon severed the dollar's link to gold and essentially killed Bretton Woods in the early 70s, the IMF has been looking around for a job. I guess it would have made too much sense to disband an agency whose mission was no longer valid. Second, the IMFs more recent role as lender of last resort to emerging market economies has produced questionable results at best. The moral hazard created by the existence of an IMF prepared to bail out any country that digs a deep enough hole means that profligate governments never receive the market punishment they deserve and that would teach them to follow basic, sensible economic policies. And lastly, the US is the biggest contributor to the fund; why should we give up any leadership position at the fund when it is lending our money? Who needs the IMF? No One! Click on the title to read the whole story.

Friday, September 15, 2006

Inflation or Lack Thereof

The Labor Department reported the Consumer Price Index this morning rose 0.2% in August:

Energy was only up 0.3% in August vs a 2.9% increase in July and of course we've seen a significant drop since August so inflation continues to moderate. We have stated previously that we believe inflation peaked in April or May and we continue to believe that to be the case.

The tame CPI and slowing economic growth should continue to keep the Fed on the sidelines. Industrial production and capacity utilization were also reported today and while production dropped 0.1% that was mostly due to a drop in utility output as the summer heat waves passed. Manufacturing output was flat vs July but up 5.4% year over year. Capacity Utilization was down slightly to 82.4%. All this points to an economy that is slowing but not falling into recession, which is what the Fed is expecting.

Our current investment stance is unchanged: underweight commodities and REITs and overweight Large Cap. Small cap is slightly underweight. We believe that as the economoy slows, investors will move toward the larger company stocks and away from the more economically sensitive small caps. While we don't expect a significant fall in the small cap indexes we do believe that Large Cap will continue to outperform as it has over the last year and by an increasing amount as the year progresses.

CONSUMER PRICE INDEX: AUGUST 2006

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in August, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The August level of 203.9 (1982-84=100) was 3.8 percent higher than in August 2005.

Energy was only up 0.3% in August vs a 2.9% increase in July and of course we've seen a significant drop since August so inflation continues to moderate. We have stated previously that we believe inflation peaked in April or May and we continue to believe that to be the case.

The tame CPI and slowing economic growth should continue to keep the Fed on the sidelines. Industrial production and capacity utilization were also reported today and while production dropped 0.1% that was mostly due to a drop in utility output as the summer heat waves passed. Manufacturing output was flat vs July but up 5.4% year over year. Capacity Utilization was down slightly to 82.4%. All this points to an economy that is slowing but not falling into recession, which is what the Fed is expecting.

Our current investment stance is unchanged: underweight commodities and REITs and overweight Large Cap. Small cap is slightly underweight. We believe that as the economoy slows, investors will move toward the larger company stocks and away from the more economically sensitive small caps. While we don't expect a significant fall in the small cap indexes we do believe that Large Cap will continue to outperform as it has over the last year and by an increasing amount as the year progresses.

Thursday, September 14, 2006

Send More Witch Doctors

The title of this post is the retort that supply side economists used when others disparaged their thinking as "Voodoo Economics". Of course, many have talked about the irony of Bush the Younger using the Voodoo Economics that his father disdained. I am not a supply sider - I think of myself more along the lines of a classic liberal -- but some of the policies that supply siders advocate, such as cutting marginal tax rates, fit in with my philosophy. In fact, the Laffer Curve was first demonstrated in Congress way back in the 1830s to demonstrate the futility of raising tariffs too high by none other than John C. Calhoun. So, much to my father's chagrin, my family has a long history with Voodoo Economics. This story from National Review Online by Ashby M. Foote III discusses the disparity between the two employment surveys.

The gist of the story is that the household survey captures new small businesses that are formed while the establishment survey only captures the jobs created by larger companies. The disparity is caused by the ease of new business formation and the changing ways that technology allows people to work. Glenn Reynolds, of Instapundit fame, talks about this in his book, "An Army of Davids" and the author of this article mentions Chris Anderson's "The Long Tail" both of which I enjoyed and generally agree with. However, I would point out that over time the household survey and the establishment survey tend to even out so I'm not sure there's anything to this. I would think that if the economy were creating that many jobs, consumer confidence would be appreciably higher. Maybe all those "Davids" have created a job because they couldn't find one at an established firm?

If you wonder what a "classic liberal" is, I'll just say it has nothing to do with the current usage of the term and point you to this book "Reviving the Invisible Hand: The Case for Classical Liberalism in the Twenty First Century" by Deepak Lal.

If you have one of the 3.3 million jobs the Labor Department can’t explain, please contact Secretary Elaine Chao at www.dol.gov. That’s right: 3.3 million new jobs is the cumulative difference between the Labor Department’s two ongoing surveys (payroll and household) since the current economic expansion began in November 2001.

The gist of the story is that the household survey captures new small businesses that are formed while the establishment survey only captures the jobs created by larger companies. The disparity is caused by the ease of new business formation and the changing ways that technology allows people to work. Glenn Reynolds, of Instapundit fame, talks about this in his book, "An Army of Davids" and the author of this article mentions Chris Anderson's "The Long Tail" both of which I enjoyed and generally agree with. However, I would point out that over time the household survey and the establishment survey tend to even out so I'm not sure there's anything to this. I would think that if the economy were creating that many jobs, consumer confidence would be appreciably higher. Maybe all those "Davids" have created a job because they couldn't find one at an established firm?

If you wonder what a "classic liberal" is, I'll just say it has nothing to do with the current usage of the term and point you to this book "Reviving the Invisible Hand: The Case for Classical Liberalism in the Twenty First Century" by Deepak Lal.

I think I'll have a Drink

I stop by the Reason Foundation website regularly to see what the hard core libertarians are talking about. I ran across this today and had to share it with everyone. They've done a study that purports to show that social drinkers make more money than non drinkers.

This seems like an opportune time to mention that we'll be hosting a wine tasting at the end of the month. Details to come......

A number of theorists assume that drinking has harmful economic effects, but data show that drinking and earnings are positively correlated. We hypothesize that drinking leads to higher earnings by increasing social capital. If drinkers have larger social networks, their earnings should increase. Examining the General Social Survey, we find that self-reported drinkers earn 10-14 percent more than abstainers, which replicates results from other data sets. We then attempt to differentiate between social and nonsocial drinking by comparing the earnings of those who frequent bars at least once per month and those who do not. We find that males who frequent bars at least once per month earn an additional 7 percent on top of the 10 percent drinkers’ premium. These results suggest that social drinking leads to increased social capital.

This seems like an opportune time to mention that we'll be hosting a wine tasting at the end of the month. Details to come......

Oil Prices/Commodities

The title of this post links to a story in the Seattle Times that quotes an energy consultant:

I don't know if prices are about to plunge, but the story does make some good points. Much of the run up in oil prices to over $70 per barrel really had little to do with supply and demand and a lot to do with speculation in commodity markets. Much of this speculation was based on political factors such as unrest in Nigeria and the Middle East. Others speculated that global warming would continue to produce hurricane seasons like last year that would disrupt supplies in the Gulf of Mexico.

There isn't exactly peace in the Middle East but at least the Israeli Army has pulled back. Nigeria is still a dangerous place but the world seems to have adjusted to that reality. Hurricane season has so far been a non event. And inventories are so high there are reports of some oil companies leasing tankers for storage. In other words, the market has responded exactly as one would expect.

Oil isn't the only commodity that seems to have peaked. Gold and other metals have fallen too. The commodity indexes have seen some pretty severe corrections over the last couple of months. We tend to think it has more to go and remain underweight the commodity stocks and indexes.

The drop in commodity prices also tends to reinforce our belief that the Fed is at the top of it's rate raising cycle. The drop in oil and particularly gold should give the Fed some comfort that they haven't release the inflation genie from his bottle. With housing slowing (but apparently not crashing; see the uptick in purchase mortgage applications reported yesterday) and commodities correcting, we may be headed back to the days of moderate growth and inflation -- at least for a little while.

"All the hurricane flags are flying" in oil markets, said Philip Verleger, a noted energy consultant who was a lone voice several years ago in warning that oil prices would soar. Now, he says, they appear to be poised for a dramatic plunge.

I don't know if prices are about to plunge, but the story does make some good points. Much of the run up in oil prices to over $70 per barrel really had little to do with supply and demand and a lot to do with speculation in commodity markets. Much of this speculation was based on political factors such as unrest in Nigeria and the Middle East. Others speculated that global warming would continue to produce hurricane seasons like last year that would disrupt supplies in the Gulf of Mexico.

Oil traders bet that such worrisome developments would drive up the future price of oil. Oil is traded in contracts for future delivery, and companies that take physical delivery of oil are just a small part of total trading. Large pension and commodities funds are the big traders and they're seeking profits. They've sunk $105 billion or more into oil futures in recent years, according to Verleger. Their bets that oil prices would rise in the future bid up the price of oil.

That, in turn, led users of oil to create stockpiles as cushions against supply disruptions and even higher future prices. Now inventories of oil are approaching 1990 levels.

There isn't exactly peace in the Middle East but at least the Israeli Army has pulled back. Nigeria is still a dangerous place but the world seems to have adjusted to that reality. Hurricane season has so far been a non event. And inventories are so high there are reports of some oil companies leasing tankers for storage. In other words, the market has responded exactly as one would expect.

Oil isn't the only commodity that seems to have peaked. Gold and other metals have fallen too. The commodity indexes have seen some pretty severe corrections over the last couple of months. We tend to think it has more to go and remain underweight the commodity stocks and indexes.

The drop in commodity prices also tends to reinforce our belief that the Fed is at the top of it's rate raising cycle. The drop in oil and particularly gold should give the Fed some comfort that they haven't release the inflation genie from his bottle. With housing slowing (but apparently not crashing; see the uptick in purchase mortgage applications reported yesterday) and commodities correcting, we may be headed back to the days of moderate growth and inflation -- at least for a little while.

Wednesday, September 13, 2006

Chicago Fed Housing Boom Study

The Chicago Federal Reserve Bank recently published a study that attributes the housing boom not to loose monetary policy but a host of other factors out of the Fed's control. In a related story, my daughter recently disclosed that the mess in her room was caused by an invisible troll who lives in her closet.

So, the Chicago Fed believes that the explosion of sub-prime lending is not related to loose monetary policy? They claim that "levels of spending on housing are largely explained by the wealth created by dramatic technological progress over the previous decade", an apparent reference to the tech bubble, but can't seem to connect the tech bubble to loose monetary policy either. Call me a cynic but I don't think the Chicago Fed will ever find an inflated asset that was caused by loose monetary policy.

Our main findings are as follows. First, it appears that the housing boom has not been driven by unusually loose monetary policy. This is not to say that monetary policy has not been unusually loose, but that to the extent it has been loose, this is not what has been driving spending on housing. Second, the current levels of spending on housing are largely explained by the wealth created by dramatic technological progress over the previous decade. Third, changes in the demographic, income, educational, and regional structure of the population account for only one-half of the increase in homeownership. ... The last finding is that substitution away from rental housing made possible by technology-driven developments in the mortgage market, such as subprime lending, could account for a significant fraction of the increase in residential investment and homeownership. The current spending boom thus may be a temporary transition toward an era with higher homeownership rates and a share of spending on housing that is nearer historical norms.

So, the Chicago Fed believes that the explosion of sub-prime lending is not related to loose monetary policy? They claim that "levels of spending on housing are largely explained by the wealth created by dramatic technological progress over the previous decade", an apparent reference to the tech bubble, but can't seem to connect the tech bubble to loose monetary policy either. Call me a cynic but I don't think the Chicago Fed will ever find an inflated asset that was caused by loose monetary policy.

Monday, September 11, 2006

Weekly Economic Calendar

Click on the title to get this week's economic calendar. Friday is the big day this week with several important reports, the most anticipated being CPI. Capacity Utilization and Industrial Production also come out Friday though and we think those reports actually have a greater capacity to move the market than CPI. Tomorrow we get the Trade report which we think is mostly irrelevant, Thursday brings export and import prices and retail sales. Data recently has pointed toward an economic slowdown and moderating inflation; we think that will continue this week.

Friday, September 08, 2006

More Forecasting Follies

Last month I wrote about the futility of economic forecasting. The post is here.

Now there's a new post about the same subject on TCS Daily:

At AIM we invest such that we don't have to forecast the market or the economy. In fact, we will tell anyone who cares to listen that we cannot predict the future. Thankfully, a crystal ball is not required to be a good investor. Anyone who tells you that they can predict something as complex as the stock market or the economy is either lying or deluded.

Now there's a new post about the same subject on TCS Daily:

The imprecision of economic forecasts isn't a comment on the forecasters' intelligence or work ethic. Rather, it demonstrates that the economy is too complex a system to be adequately captured by existing modeling techniques. The rational response to this realization is a combination of caution and humility.Read the rest by clicking on the title of this post.

At AIM we invest such that we don't have to forecast the market or the economy. In fact, we will tell anyone who cares to listen that we cannot predict the future. Thankfully, a crystal ball is not required to be a good investor. Anyone who tells you that they can predict something as complex as the stock market or the economy is either lying or deluded.

Wednesday, September 06, 2006

Unit Labor Costs to Fuel Inflation?

The Labor Department released figures today on productivity and unit labor costs for the second quarter. Both were disapointing with productivity posting a 1.5% gain while unit labor costs were up 4.8%. Of course the two go together; lower productivity will naturally result in higher unit labor costs. Unit labor costs rose at a slower pace than the first quarter when they rose 9%, but that's small consolation for those hoping that inflation has peaked (that would include us). Of course, there's no guarantee that higher unit labor costs will result in higher inflation as companies could choose to book lower profits. However, it seems everyday that we read about some company or another raising prices. The most recent example is Caterpillar which announced yesterday that they will be raising prices in January.

In the Federal Reserve's Beige Book report (isn't that a perfect name for a report from a bunch of economists?) this afternoon there are hopeful signs:

The report also characterized the real estate markets much as we have:

We have been arguing that a housing market slowdown will be at least partially offset by an increase in commercial construction. It's good to see some confirmation.

The market has responded negatively to the economic news today (or perhaps we were just due for a pullback after the August gains), but overall, we don't see much change. The Fed is still likely to sit on their hands at the September meeting.

Beige Book Report

In the Federal Reserve's Beige Book report (isn't that a perfect name for a report from a bunch of economists?) this afternoon there are hopeful signs:

Labor markets were mostly described as steady since the last report, with scattered labor shortages and associated upward wage pressures noted in a number of Districts, especially for workers with specialized skills. Widespread increases in the prices of energy and certain other commodities persisted since the last report, though most of these increases do not appear to have passed through to finished consumer goods.

The report also characterized the real estate markets much as we have:

Housing markets and home construction activity weakened throughout the nation, but commercial real estate and construction strengthened in most Districts....Commercial real estate markets were uniformly described as strong and, in most cases, increasingly so. Office markets showed noticeable signs of improvement in the Boston, New York, Philadelphia, Atlanta, Chicago, Minneapolis, Kansas City, Dallas and San Francisco Districts.

We have been arguing that a housing market slowdown will be at least partially offset by an increase in commercial construction. It's good to see some confirmation.

The market has responded negatively to the economic news today (or perhaps we were just due for a pullback after the August gains), but overall, we don't see much change. The Fed is still likely to sit on their hands at the September meeting.

Beige Book Report

Tuesday, September 05, 2006

Could China make Kim Jong Ill?

Ted Galen Carpenter of the Cato Institute has an op ed in the Wall Street Journal this morning that endorses the notion, long held here, that the key to North Korea is stored on China's key ring. Without Chinese support North Korea will fold like a cheap tent. China's concern is that if Kim Jong Il is taken down, there will be a flood of refugees into China. That's possible I suppose, but should be manageable if handled properly. Should we encourage China to depose the North Korean Pompadour? Sounds okay to me. Read the whole story by clicking on the title (subscription may be required).

Weekly Economic Calendar

Click on the title to look at this week's economic data calendar. Highlights are:

Wednesday we get a look at productivity and unit labor costs. If the US is going to avoid inflation, productivity must keep rising. The ISM reports it's services index as well.

Thursday brings the weekly jobless claims and Wholesale Trade numbers. We also get oil inventory numbers.

Friday's lone report is on consumer credit.

There are probably no market movers in this week's numbers although the unit labor costs numbers could prove interesting. The consensus is for a rise of 4% which seems quite high to us. That number should start to moderate as the economy slows, but so far there is no sign of it. Could this be the beginning of wage push 70s style inflation? We hope not....

Wednesday we get a look at productivity and unit labor costs. If the US is going to avoid inflation, productivity must keep rising. The ISM reports it's services index as well.

Thursday brings the weekly jobless claims and Wholesale Trade numbers. We also get oil inventory numbers.

Friday's lone report is on consumer credit.

There are probably no market movers in this week's numbers although the unit labor costs numbers could prove interesting. The consensus is for a rise of 4% which seems quite high to us. That number should start to moderate as the economy slows, but so far there is no sign of it. Could this be the beginning of wage push 70s style inflation? We hope not....

Friday, September 01, 2006

Won't Get Fooled Again

There's nothing in the street

Looks any different to me

And the slogans are replaced, by-the-bye

And the party on the left

Is now the party on the right

And the beards have all grown longer overnight

From "Won't Get Fooled Again" by The Who

As most of you know by now, I consider myself a libertarian. I don't trust politicians of any party; I think they are all pretty much the same. Another thing I don't trust are government economic statistics. Our government naturally wants the economic stats to look good -- especially before an election. Here's an article at Mises Institute about how the government manipulates the inflation numbers. This article doesn't even delve into things like hedonic adjustments that further distort the numbers, but it will at least give you an idea of how they manipulate the numbers and why. Read the entire story by clicking on the title of this post.

Construction Spending Drops in July

The US Census Bureau reported today that construction spending dropped 1.2% in July from the June reading. However, spending was still 5.1% above last July so things aren't exactly falling apart. As we have stated many times, we believe construction spending will fall but with commerical building activity picking up, we don't think it will be a major drag on the economy. Here's an interesting question though -- why does the Census Bureau report construction spending? I guess they need something to do when they aren't doing census stuff every ten years.

Pending Home Sales Index Falls

Pending Home Sales Index Points To Easing Market

WASHINGTON (September 1, 2006) – Home sales should be leveling out in the months ahead at a lower pace, according to an index based on pending home sales, a leading indicator for the housing market published by the National Association of Realtors®.

The Pending Home Sales Index,* based on contracts signed in July, is down 7.0 percent to a level of 105.6 from a downwardly revised reading of 113.5 in June, and is 16.0 percent lower than July 2005.

This shouldn't be a surprise to anyone. It's been obvioius for some time now that the real estate market is slowing. We continue to believe that while real estate will slow down, it will not crater because mortgage rates are also falling and the economy continues to add jobs. We also note that while the declines seem severe, sales are falling from a very high level.

ISM Survey

Manufacturing Expanded in August, but at a Slower Pace Than July

WASHINGTON (AP) -- The nation's manufacturing sector expanded in August at a slower clip than in July amid rising commodity prices, a trade group said Friday.

The Institute for Supply Management, based in Tempe, Ariz., said its manufacturing index registered 54.5 in August, just below the 54.7 July reading. Analysts expected the index to be flat.

The ISM survey shows growth in manufacturing (and apparently increased productivity since manufacturing shed jobs last month) that was basically unchanged from July. Another report that supports the Fed view of a slowing economy. If the economic data continues to come in like this, the Fed is probably done raising rates.

Jobs Report

Employers Add 128,000 Jobs in August

WASHINGTON (AP) -- Hiring perked up in August as employers added 128,000 jobs, pulling the unemployment rate down to 4.7 percent and flashing a Labor Day weekend message of an economic expansion that still has staying power.

The jobs report was pretty much as expected. Job gains were in healthcare, food services, financial services, and mining. Losses were in retail and manufacturing. Surprisingly, construction added jobs in the month. Hourly earnings were up just 0.1% which bodes well for inflation.

Stock traders seem to like the report with the Dow up about 80 points as of this writing. The bond market is essentially unchanged. This report further reinforces the idea that the Fed has gotten it right. The economy is slowing but not falling off a cliff into recession. We think that is probably right, but further weakness would be a cause for concern.

Subscribe to:

Posts (Atom)