In 1976, Howard Beale, a character in the movie Network, urged Americans to get up, go to their windows, open them and yell out, “I’m mad as hell and I’m not going to take this anymore!” The preamble to Beale’s speech chronicles the problems of the 1970s: inflation, a falling dollar, unemployment, environmental degradation and crime. Here we are over 30 years later and we’re living another Howard Beale moment. Unfortunately, based on the solutions offered by our political leaders, I guess I’ll have to stay that way. What I don’t have to do is remain quiet about it.

There are real problems that face our country now and our political leaders cannot be trusted to provide the only solutions. Most do not have the guts to say what needs to be said for fear of alienating some group of supporters. And many do not have the integrity to stand on principle and advocate unpopular but necessary policies. Too often, politicians tow the line of special interest groups and campaign contributors instead of doing what is right for the country. It is high time that politicians were held responsible for the damage done by policies that benefit the few at the expense of the many.

In this election year, the greatest concern for most Americans is the economy and there is good reason for that. Unemployment, foreclosures and prices are all rising. The stock market, home prices and the dollar are all falling. Economic growth is still positive but well below potential. The situation is not as bad as during the 70s, but they are moving in that direction. And Americans are rightly worried.

At whom should we direct our anger? That is the question that is not being asked by enough Americans and not being answered to anyone’s satisfaction. Politicians and others are manipulating public opinion through the media by offering seemingly made-to-order villains such as Angelo Mozillo, Exxon-Mobil and the amorphous but always reviled “speculator.” Americans with little understanding of economics are easily misled by propaganda that indicts the market on charges of perfidy while sanctifying politicians who cast themselves as champions of the downtrodden. The true villains remain hidden away from public view.

Complicating the task of unmasking those villains is the resilience of the US economy. Keep in mind, the country’s economic growth has been weak but we have yet to register a negative quarter. Second-quarter growth will probably be reported at around 3% and you can bet there will be a line of politicians eager to take credit. Most economists expect the second half of the year to be weaker but if oil prices keep falling they may be as wrong about the second half as they were about the first.

The underlying problems, however, will not have been solved no matter what the performance of the economy is over the next few quarters or years.

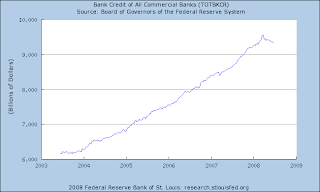

In a recent market commentary, Bill Gross called access to credit “the mother’s milk of capitalism.” That sentiment, echoed by our politicians and policy makers, is the source of our problems. It is not credit but capital that is the lifeblood of capitalism and the US doesn’t accumulate enough capital to support the growth that we’ve become accustomed to. The savings rate has ticked somewhat higher over the last few months, but for years we’ve saved too little and spent too much. To make up for that difference we’ve depended on other countries, such as China, which now owns over $1 trillion of US debt. Middle Eastern countries own even more of us.

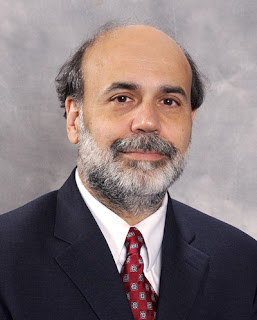

In their efforts to revive the credit markets, the Federal Reserve and their political enablers may have averted an economic crisis in the short-term, but the long-term implications have yet to be reckoned. Bear Stearns, Fannie Mae and Freddie Mac – deemed too big to fail – were given access to the public purse rather than face the consequences of excessive leverage. Now the acceptable cure for excessive private indebtedness is more public indebtedness. Private players will reap the benefits if these transactions turn out profitable while the public will pay the price if they don’t.

Large financial institutions were encouraged to take on too much leverage and take too many risks by a Federal Reserve that held interest rates at artificially low levels for far too long. Rather than allow these companies to suffer the consequences of their actions our leaders are working overtime to ensure they continue to take imprudent risks in the future. The Fed has allowed overleveraged institutions to borrow funds at attractive rates with dubious collateral. Savers are punished with low interest rates while speculative players are encouraged to find new avenues for their speculation. Oil prices would seem to indicate they’ve found a new outlet for their speculative impulses.

The same is true of individuals who borrowed too much to buy homes they couldn’t afford. I feel for the people who face foreclosure but why should those of us who were prudent be forced to bail out those who weren’t? The recently passed housing bill will allow both lenders and borrowers to forgo the consequences of their actions. And again, if everything works out the lenders and borrowers will benefit while failure is assigned to the taxpayer. It would be better for the foreclosures to proceed and former homeowners to become renters again. The real estate market would face a further increase in inventory but prices could finally fall to market clearing levels. That would make housing affordable for those who have saved and acted prudently.

Over the last 50 years (at least) but especially during the last 30 years, every economic problem has been buried under another layer of credit and government intervention. The Federal Reserve and Congress have worked together to promote an economic environment where failure is deemed a threat to the “system” and all economic ills are “solved” by reducing the cost of credit. The result is plain for all to see. The US has moved from creditor to debtor nation. Debtors are bailed out through the tax code while savers are consigned to a prison of low interest rates. It is no surprise that we must import capital to cover our debts when we encourage debt and discourage saving.

The long-term problems facing our economy will not be solved painlessly, nor will they be solved by providing more of the same policies that got us to this point in the first place. While the Federal Reserve sits at the center of our problems the institution itself is not at fault. They have been given an impossible dual mission to maintain economic growth and to limit inflation. Having control only over the money supply, it is beyond the capabilities of the Fed to create growth. Inflation and credit expansion do not add anything to the amount of resources available or the capital stock. The Fed cannot create universal prosperity by creating more money. Inflation consumes precious capital by misdirecting resources into non economic investments. If you have any doubts about that, think of all the empty houses sitting around the country which attracted so much investment over the last decade. The capital devoted to housing was diverted from more productive uses and is now being destroyed as banks are forced to write off bad loans.

The villains in this story are the inhabitants of our political institutions. They seek to buy our votes with our own money and when they find that is not enough, they turn to the Federal Reserve and the banking system to create more. Rather than raise taxes to pay for the goodies they promise or the wars they deem necessary, they depend on debt and inflation. They do not create jobs, but destroy them. They do not create equality but exacerbate the divide between the haves and have nots and manipulate the divide to accrue more power. They do not create capital but rather destroy it. They are not special but mere mortals susceptible to the same failings as all people. They are self interested actors acting on a stage of their own design in a play written for their own benefit.

It seems evident that the housing bubble that is the source of the current economic malaise was caused by Federal Reserve policy. Does it not seem perverse to turn to the same institution for a remedy? How can they be expected to prescribe a remedy when they obviously don’t understand the malady?

It would seem more logical to proscribe the manipulation of interest rates for any purpose other than to achieve price stability. While a gold standard or some other real asset backed currency would be preferable and less susceptible to political manipulation, setting a single goal for the Fed is preferable to the current situation. Higher interest rates are obviously needed to reduce the inflation evident to everyone except the government statisticians. Higher interest rates would also encourage saving and discourage further debt accumulation.

It also seems evident that the government budget deficit is a result of excessive spending rather than a lack of taxation. Tax revenue has been remarkably stable as a percentage of GDP for many years, ranging between 18% and 21% regardless of tax rates. Right now it stands at 19%. Furthermore, other countries, such as Hong Kong, are able to collect nearly the exact same percentage of revenue with much lower tax rates. Hong Kong has income tax rates, personal and corporate, of less than 20% and generates a budget surplus while spending over 15% of GDP on government services. Hong Kong also doesn’t tax capital gains or dividends. We do not need higher taxes to generate the revenue needed for essential government services. We do need to decide what is essential.

In particular, it is illogical to raise taxes on capital when the basic problem we face is a lack of capital. If anything, taxes on capital should be further reduced to encourage accumulation of the capital needed to fund our growth. As for income taxes, it is time for Americans to assess the wisdom of taxing the very thing we wish to generate. If it is logical to tax cigarettes to discourage smoking, what is the logic for taxing income? A consumption tax coupled with repeal of the income tax would realign incentives toward a more rational economy based on thrift and savings rather than conspicuous consumption.

It is time for the citizens of these United States to take back our Republic from the thieves and parasites that occupy the seats of power. Power in this country was intended to reside in the people and the states. A class of citizens numbering less than 600 now hold that power in Washington, D.C. and we have no one to blame but ourselves. It is time to get angry.