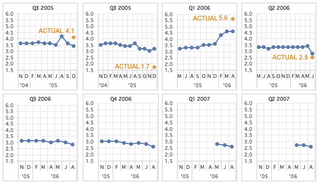

The graphs above show the average GDP growth forecasts of the survey vs the actual GDP growth results and the average forecast for future GDP growth. As you can see, the forecasts and results appear to be almost random. Should we care what they are forecating in the future?

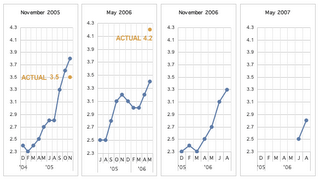

Here's another example from the CPI (inflation) forecasts:

Again, it doesn't appear that the average forecasts provide us with any useful information. The consensus on these things almost always turns out to be wrong and yet the market moves, sometimes violently, when these numbers are reported to be above or below consensus. Why?

The more interesting information in these surveys, in my opinion, is in the extremes. What is the highest and lowest forecasts for these various data points?

The highest estimate of Q3 GDP growth in the survey is 4.2%. The lowest estimate is 1.5%. The likelihood that the number falls somewhere between those two numbers is probably pretty high. Based on past results, it seems unlikely that the number will fall near the average. So, the trick it seems to me is to try and determine which extreme is more likely and which would be a greater surprise. Why? Because that's what would produce the greatest move in the market. So, what would be the greatest surprise right now?

The Fed is expecting, and I believe that market participants are expecting, the economy to slow. The Fed's hope is that slower growth will produce lower inflation and mitigate the need for further rate hikes. Based on recent market action, it appears that market participants are worried that the Fed has been too successful in their campaign to slow the economy. They are worried about recession. Since the market is already worried about that, it is being discounted. Therefore, the biggest market moving event would be if growth came in near the highest forecast rather than the lowest.

There is useful information in these surveys, it's just not what the WSJ is reporting. The averages are useless except to determine what is least likely. The extremes provide more useful, actionable information.

No comments:

Post a Comment