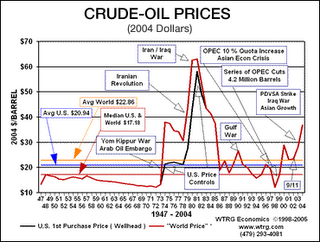

Returning to current monetary blunders, every supposed oil and commodity “shock” since 1971 has occurred alongside a major drop in the value of the dollar versus gold, and subsequently all commodities. Since both oil and copper are world commodities, the fact that their prices have risen so substantially in dollars as opposed to euros in recent years makes plain the impact of dollar instability on the nominal price of commodities.

We invest in commodities because we don't trust the Federal Reserve (or the US Government if you prefer) to maintain the purchasing power of the dollar. History tells us that fiat currencies are inherently unstable and are ultimately undermined by the governments that use them. Since our mission is to protect the wealth that our clients have worked so hard to accumulate, we believe it is essential to maintain some exposure to commodities at all times. We can and do vary the percentages we have invested in commodities based on current conditions, but since so many crises are associated with commodity spikes, we think it is prudent to maintain some exposure at all times. We are currently undeweight commodities and in the current correction even that has hurt our performance, but we'll take some short term pain to ensure that our clients purchasing power is protected in the long term. Click on the title to read the whole story.

No comments:

Post a Comment